2022 tax brackets

The agency says that the Earned Income. 2022 Standard Deduction Amounts The standard deduction amounts will increase to 12950 for individuals and married couples filing separately 19400 for heads of.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

4 hours agoThe IRS revised tax brackets and raised standard deductions in response to rising inflationary pressure it announced.

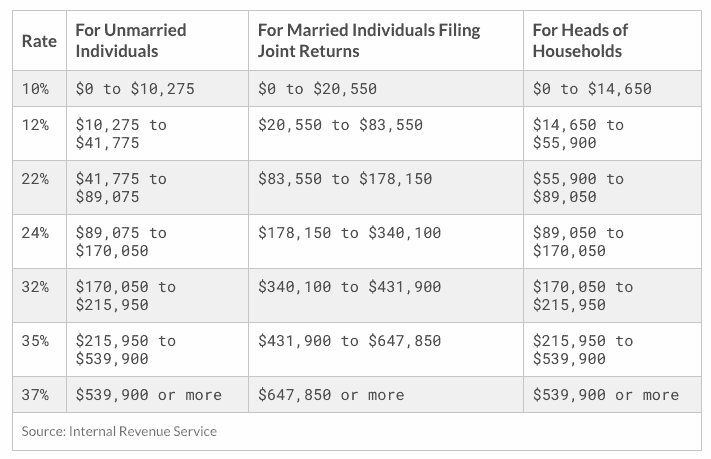

. The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for qualifying taxpayers who have three or more qualifying children up from 6728 for tax year. 2022 tax brackets Thanks for visiting the tax center. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

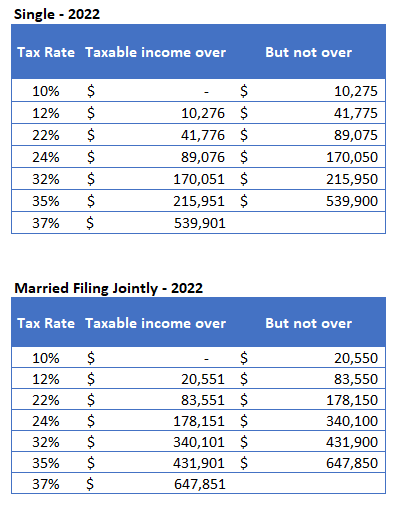

5 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

In the coming year individuals who earn 578125 and joint-filing. Changes apply in 2023. There are seven federal income tax rates in 2023.

4 hours ago2022 tax brackets for individuals. The 2022 tax brackets affect the taxes that will be filed in 2023. 9 hours agoHigher standard deduction The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022.

Up from the maximum of 6935. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up. These are the rates for.

The top marginal income tax rate. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals. 7 hours agoThe tax rate goes down per each lower tax bracket giving middle-class earners the lions share of the benefits.

8 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. Single filers may claim. There are seven federal income tax rates in 2022.

Below you will find the 2022 tax rates and income brackets. The IRS changes these tax brackets from year to year to account for inflation. The top tax rate for individuals is 37 percent for taxable income above 539901 for tax year 2022.

To access your tax forms please log in to My accounts General information. 23 hours agoSo for example the lowest 10 ordinary income tax bracket will cover the first 22000 of taxable income for a married couple filing jointly up from 20550 in 2022. Resident tax rates 202122 The above rates do not include the Medicare levy of 2.

Heres a breakdown of last years income. The seven tax rates remain unchanged while the income limits have been adjusted for inflation. If you have questions you can.

Each of the tax brackets income ranges jumped about 7 from last years numbers. Resident tax rates 202223 The above rates do not include the Medicare levy of 2. 10 12 22 24 32 35 and 37.

Your bracket depends on your taxable income and filing status. The 2022 and 2021 tax bracket ranges also differ depending on your filing status. 1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140.

Federal Income Tax Brackets 2022. The top marginal income tax rate. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million.

There are seven federal tax brackets for the 2021 tax year.

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

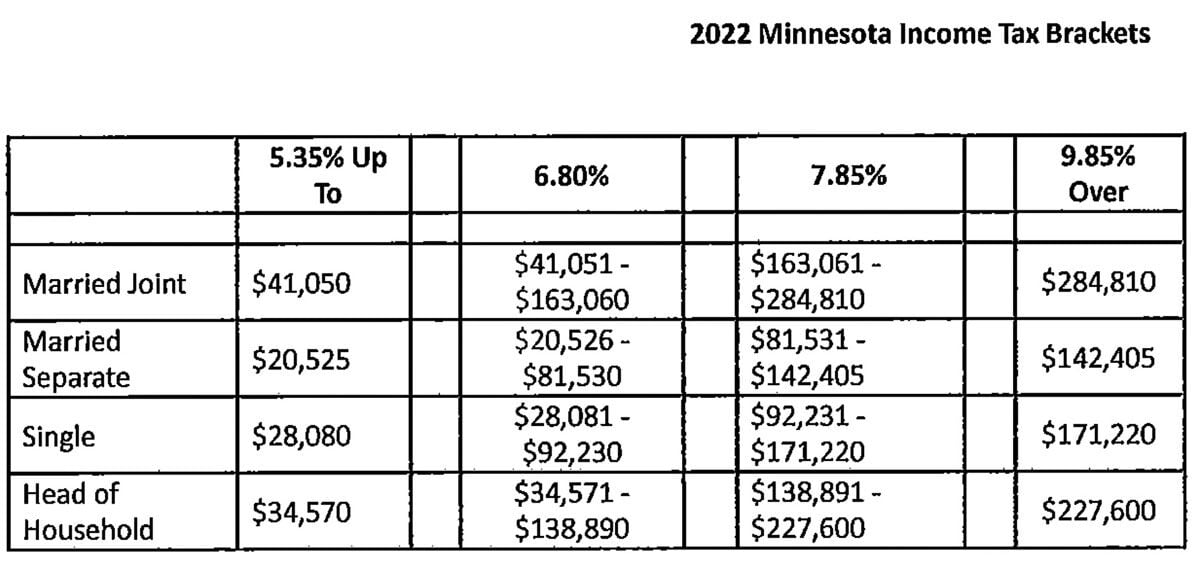

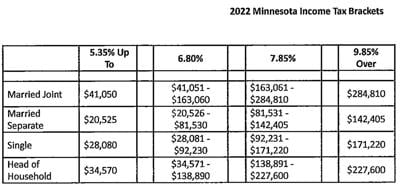

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

Taxtips Ca Ontario 2021 2022 Personal Income Tax Rates

2022 Tax Inflation Adjustments Released By Irs

2022 Tax Brackets Darrow Wealth Management

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Federal Income Tax Brackets For 2022 What Is My Tax Bracket

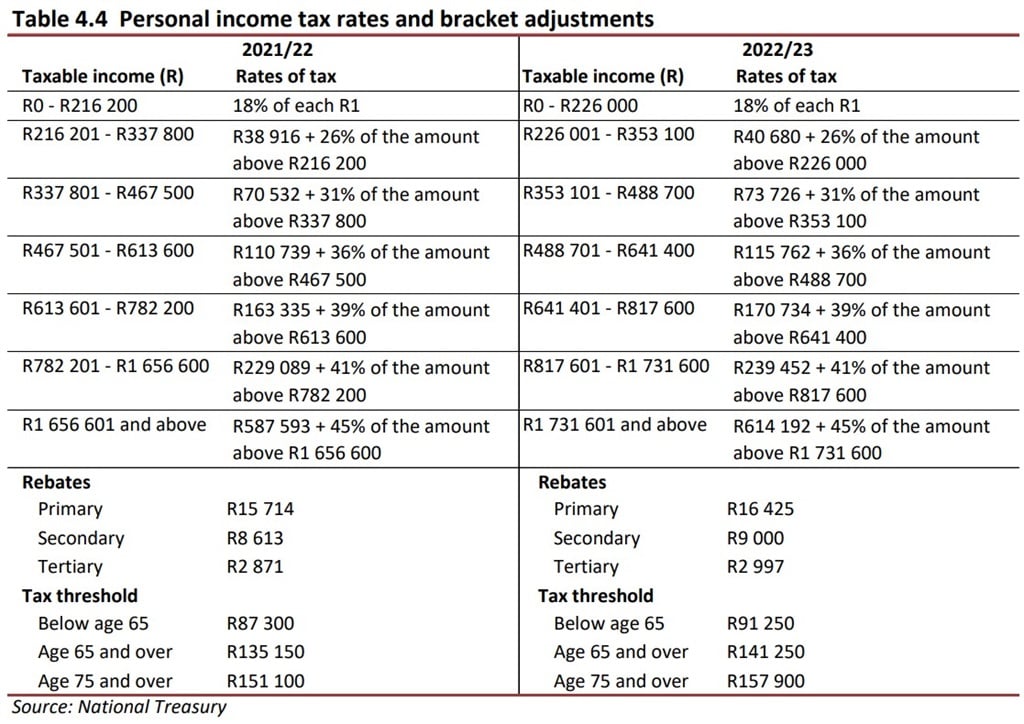

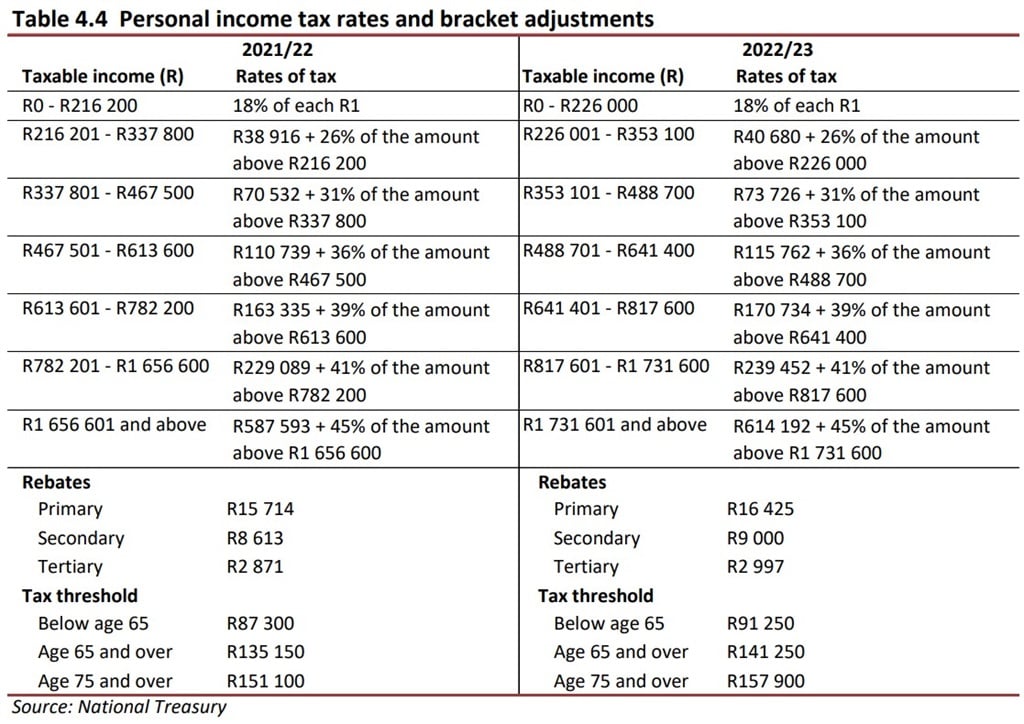

Budget 2022 Tax Relief These Are All The Big Changes Fin24

Germany Taxes Germany Income Tax Germany Tax Rates Germany Economy Germany Business For Enterpenures 2022

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

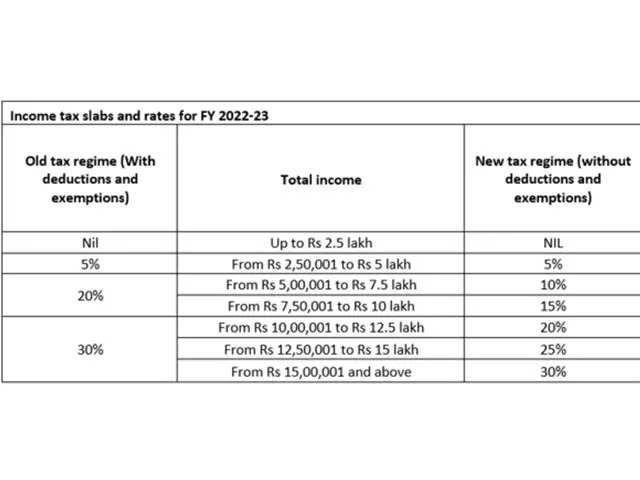

Budget 2022 Maintains Status Quo On Income Tax Rates Taxpayers Pay As Per These Slabs No Change In Personal Income Tax Slabs The Economic Times

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

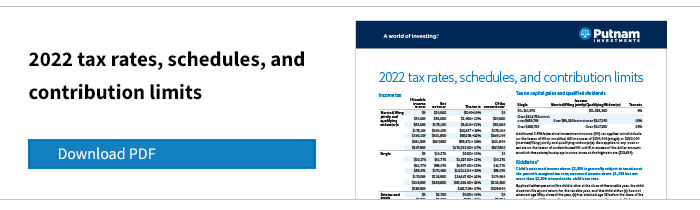

Investor Education 2022 Tax Rates Schedules And Contribution Limits

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc